National Institutional & Change Management Expert - REMIT Programme

- Hybrid

- Islamabad , Islamabad, Pakistan

- Project Positions

Job description

Brief overview

The Government of Pakistan, in collaboration with the Asian Development Bank (ADB) and other development partners, established the National Disaster Risk Management Fund (NDRMF) to address critical gaps in disaster risk management, resilience building, and disaster risk financing. Since its establishment, NDRMF has strengthened institutional systems, recruited skilled professionals, and developed comprehensive procedures aligned with donor requirements, including financial management, procurement, project appraisal, gender mainstreaming, and safeguards compliance.

These efforts have led to a significant expansion of the Fund’s scope and portfolio from an initial USD 200 million (from ADB and the Australian Government) to USD 420 million, now supported by multiple bilateral and multilateral donors including the ADB, World Bank, DFAT, AFD, SDC, and the Norwegian Government. In line with global priorities and evolving national needs, NDRMF’s mandate in its Business Strategy has expanded to include climate change adaptation and mitigation, pandemic response, and food security interventions. The Fund is now positioned to serve as Pakistan’s central platform for Disaster and Climate Financing, combining programmatic pooled and grant-based funding mechanisms across strategic pillars, and, through the Solidarity Fund, introducing insurance-based risk financing instruments.

Problem statement

Pakistan faces increasing frequency and intensity of climate-induced disasters, placing immense pressure on public resources and exposing institutional weaknesses in disaster risk financing. While the National Disaster Risk Management Fund (NDRMF) has emerged as a central financing platform, its existing mechanisms remain fragmented, donor-driven, and administratively costly. The absence of a harmonised pooled financing structure undermines predictability, transparency, and alignment with national priorities. At the same time, development partners demand assurance that financing will be managed through robust fiduciary systems and linked to measurable results. To address these gaps, NDRMF with the support of REMIT and ADB, has designed a revised Fund Architecture comprising a Pooled Fund, Special Windows, and a Solidarity Fund. However, this architecture remains at the conceptual stage and requires urgent operationalisation through integration with Pakistan’s Public Financial Management (PFM) framework, SAP-based financial systems, and harmonised donor protocols. Without timely implementation, Pakistan risks losing credibility with development partners, delaying CDREP tranche disbursements, and missing a critical opportunity to position NDRMF as the country’s premier mechanism for attracting and deploying international climate finance.

Rationale

The Government of Pakistan, in collaboration with the Asian Development Bank (ADB) and other development partners, established the National Disaster Risk Management Fund (NDRMF) in 2016 as a government-owned, not-for-profit company under Section 42 of the Companies Act, 2017. NDRMF serves as a non-banking financial intermediary with the mandate to reduce the country’s socio-economic and fiscal vulnerability to natural hazards and climate change by financing investments in disaster risk reduction, preparedness, and resilience-building.

Initially capitalised through an ADB loan of USD 200 million complemented by bilateral grants, NDRMF has since expanded its portfolio to over USD 420 million with contributions from the World Bank, DFAT/AusAid, AFD, SDC, and the Norwegian Government. Over time, its scope has broadened beyond disaster risk reduction to encompass climate change adaptation and mitigation, pandemic preparedness, and food security interventions, supported by strengthened institutional systems, professional staffing, and safeguards compliance.

To respond to evolving national priorities and international commitments, NDRMF in collaboration with REMIT/FCDO and ADB has developed a revised Fund Architecture. This includes:

· Pooled Fund as the primary programmatic financing mechanism,

· Special Windows for donor-driven thematic priorities, and

· Solidarity Fund to introduce insurance-based risk financing instruments.

This architecture, the first of its kind in Pakistan, is designed to reduce fragmentation, enhance alignment with Pakistan’s Public Financial Management (PFM) framework, improve donor harmonisation, and increase predictability and transparency in climate and disaster financing. Operationalising this new structure is also a key policy milestone under ADB’s Climate and Disaster Resilience Enhancement Program (CDREP), tied to the release of the second programme tranche.

Given the novelty and complexity of this reform, dedicated technical assistance is required to move from design to implementation while integrating fund codes into SAP systems, finalising fund flow protocols, establishing governance frameworks, and building institutional capacity. National experts will lead this process on the ground, while international experts will provide quality assurance and benchmarking to ensure the system meets international best practices.

Objectives of the assignment

Funding Architecture

With support from the REMIT Programme (funded by FCDO), NDRMF undertook a comprehensive reform of its funding architecture to align resources with strategic priorities, enhance transparency, and reduce transaction costs. Following consultations with development partners (ADB, AFD, GIZ, IsDB, World Bank, UNDP), a new framework was developed consisting of three mechanisms:

· Pooled Fund (Core Financing Mechanism) – The central vehicle for mobilising and allocating resources from multiple financing partners. The pooled fund is programmatic, harmonised, and fully integrated with Pakistan’s Public Financial Management (PFM) system, including SAP-based FMIS and the Treasury Single Account (TSA). It uses a parent–child fund code system to link financial flows with strategic outcomes and business plan priorities.

· Special Windows (Thematic / Exceptional Financing Channels) – Flexible windows established for donor-specific or emerging thematic areas that cannot be fully accommodated under the pooled fund. These remain exceptional and complementary, following the same fiduciary and safeguard standards as the pooled fund.

· Solidarity Fund (Risk Financing Window) – A specialised financing window designed to provide rapid and targeted support in response to disasters and emergencies. The Solidarity Fund introduces insurance-based disaster risk financing instruments such as crop insurance and catastrophe bonds. It is fully integrated within the overall architecture and aligned with the CDREP agenda.

This integrated architecture reduces fragmentation, strengthens alignment among donors, and creates a predictable, results-oriented system to finance disaster and climate resilience.

Scope of work: Areas of support and key results

The objective of this assignment is to fully operationalise the NDRMF Pooled Fund as the primary financing vehicle for programmatic delivery under the Fund’s revised architecture, in alignment with the Business Strategy 2024-2034 and Pakistan’s Public Financial Management (PFM) framework. The operationalisation will ensure transparent, efficient, and results-based utilisation of resources from multiple financing partners through harmonised processes, integrated systems, and robust governance mechanisms.

Specific objectives include:

· Facilitate institutional alignment among NDRMF, MoF, EAD, MoCC&EC, and development partners for fund operations.

· Design the sequencing and phased implementation plan, including piloting and gradual scaling of pooled fund operations.

· Lead consultations with ministries and donors to resolve coordination and ownership challenges.

· Support the operationalisation of Special Windows and integration of the Solidarity Fund into the overall architecture.

· Develop a results framework for fund operations aligned with CDREP policy matrix and NDRMF Business Strategy.

· Lead capacity-building workshops and training sessions for NDRMF staff and stakeholders.

Expected Results

The implementation of this fund structure will result in:

· A fully operational Pooled Fund integrated with national PFM systems.

· Special Windows and Solidarity Fund launched within the unified architecture, with harmonised fiduciary and safeguards standards.

· Strengthened donor harmonisation and reduced duplication of reporting requirements.

· Improved institutional capacity in fund management, SAP integration, and results-based allocation.

· Direct alignment with the CDREP Policy Matrix and NDRMF’s results framework, ensuring that financing contributes to measurable resilience outcomes.

Link to REMIT’s ToC and Logframe

If:

· REMIT is able to provide support for the fund architecture

Then,

· The government will be able to demonstrate to international partners its commitments and efforts to create institutional arrangements for international climate finance.

Which will eventually lead to:

At output level,

An effective institutional mechanism to attract international climate finance will be in place.

At an outcome and impact level,

Increased confidence of international partners to forward funds for climate change related interventions.

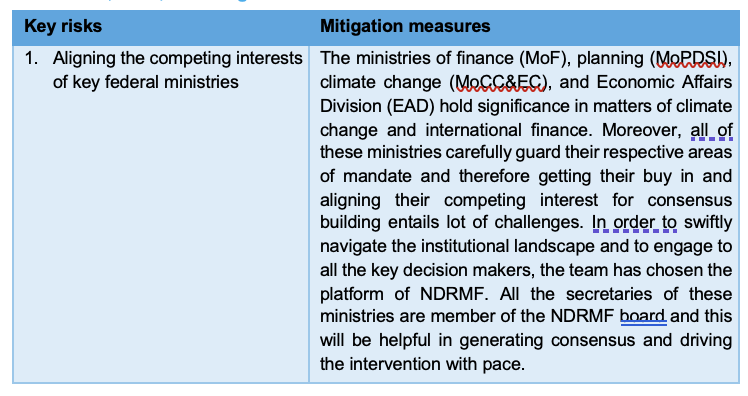

Key risks

Mitigation measures

Aligning the competing interests of key federal ministries

The ministries of finance (MoF), planning (MoPDSI), climate change (MoCC&EC), and Economic Affairs Division (EAD) hold significance in matters of climate change and international finance. Moreover, all of these ministries carefully guard their respective areas of mandate and therefore getting their buy in and aligning their competing interest for consensus building entails lot of challenges. In order to swiftly navigate the institutional landscape and to engage to all the key decision makers, the team has chosen the platform of NDRMF. All the secretaries of these ministries are member of the NDRMF board and this will be helpful in generating consensus and driving the intervention with pace.

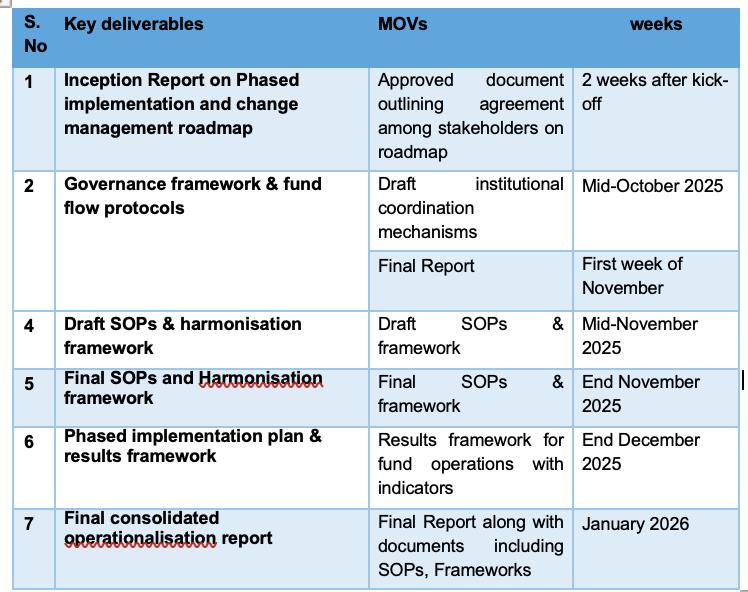

Key deliverables and timelines

PEA, risks, and mitigation measures

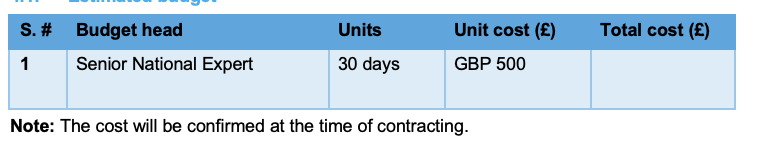

Estimated budget

Job requirements

The expert will be required to have:

· Master’s in Public Policy, Governance, or related field.

· Minimum 15 years’ experience in institutional reforms, donor coordination, or governance strengthening in Pakistan.

· Demonstrated expertise in change management and multi-stakeholder consensus-building.

· Experience in results-based management frameworks.

· Ability to work flexibly and at pace.

Reporting

The expert will report to the Output Lead and Team Leader of REMIT Programme.

Interested applicants are welcome to apply by September 09th, 2025.

or

All done!

Your application has been successfully submitted!