Senior Anti-Money Laundering and Countering the Financing of Terrorism Expert - REMIT Program

- Hybrid

- Islamabad , Islamabad, Pakistan

- Project Positions

Job description

ToRs Senior Anti-Money Laundering and Countering the Financing of Terrorism Expert

Background

The Revenue Mobilisation, Investment and Trade (REMIT) is a multi-year (2021–2027) programme funded by the UK’s Foreign, Commonwealth and Development Office (FCDO) and implemented by Adam Smith International (ASI). REMIT provides technical assistance to the Government of Pakistan to strengthen macroeconomic stability, improve growth conditions, and enhance poverty reduction efforts.

The IMF carries out Governance and Corruption Diagnostic Assessment (GCDA) which is a country-requested assessment designed to identify economic and governance vulnerabilities with macro-critical implications and to support the design of prioritised time-bound reforms. It operationalises the IMF’s 2018 framework for systematic engagement on governance and corruption by examining institutional arrangements that materially affect fiscal stability, growth, and inclusion. This is a crucial pre-condition for Pakistan’s economic growth and development.

A GCDA has been carried out by the IMF for Pakistan in 2025. The GCDA is a tool to identify critical vulnerabilities to economic growth, while the Governance Action Plan (GAP) is to fix critical economic vulnerabilities hindering economic growth.

The IMF mission conducted preliminary assessments across six core state functions: (i) fiscal governance (public financial management, tax, SOEs, and procurement), (ii) central bank governance and operations, (iii) financial-sector oversight, (iv) market regulation, (v) the rule of law (including conflict-of-interest and asset-declaration regimes), and (vi) anti-money laundering and countering the financing of terrorism (AML/CFT) where corruption proceeds interface with the financial system.

Activity Context

At the request of the Ministry of Finance, REMIT is supporting the development of a Three-Year GAP to implement the recommendations from the IMF’s Governance and Corruption Diagnostic Assessment (GCDA). The GAP will translate around the GCDA recommendations across six governance areas into actionable and time-bound reforms to fix critical vulnerabilities to economic growth. The six areas are fiscal governance, central bank, financial oversight, market regulation, rule of law and AML/CFT.

Job Summary

Responsible for developing actionable reforms related to AML/CFT to strengthen Pakistan’s financial integrity systems.

Duties and Responsibilities

· Review GCDA recommendations related to AML/CFT, especially where they intersect with corruption proceeds.

· Analyse existing institutional coordination between SBP, FMU, SECP, and LEAs.

· Develop actionable reforms for improving detection, reporting, and enforcement mechanisms.

· Align recommendations with FATF standards and ongoing national AML strategies.

· Draft relevant inputs for the Action Plan, including responsible entities, timelines, and key indicators.

· Participate in stakeholder consultations and incorporate feedback into the final draft.

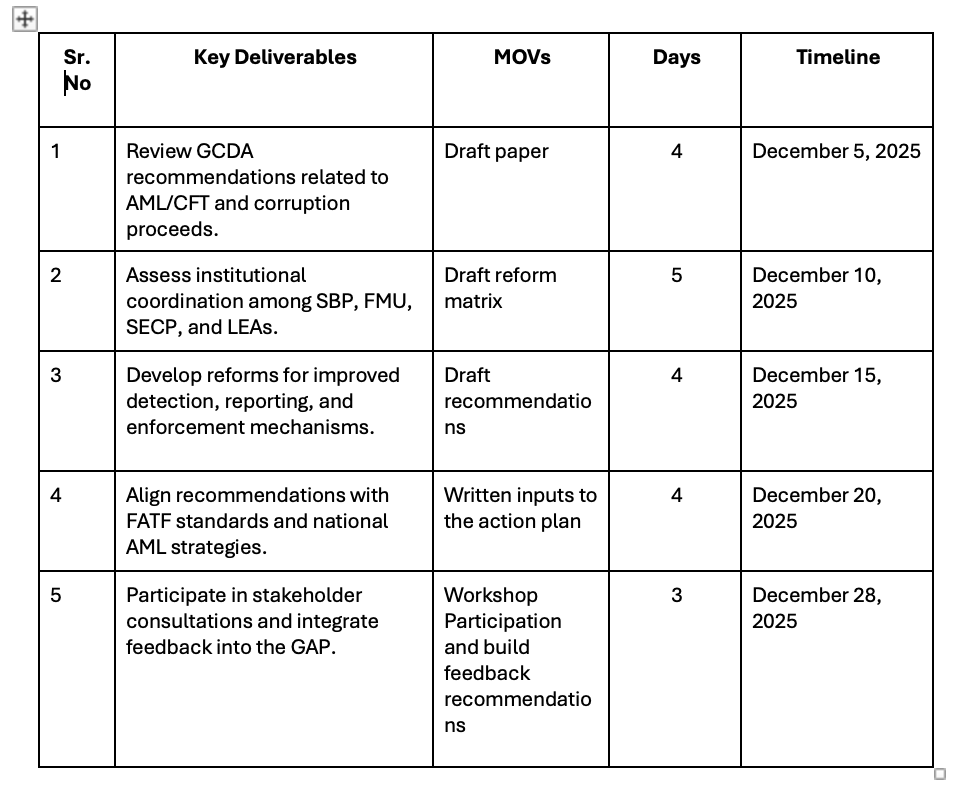

Brief Description of Deliverables

Job requirements

Qualifications and Experience

• At least 10 years of experience in AML/CFT compliance, financial integrity, or law enforcement policy.

• Demonstrated familiarity with FATF standards and Pakistan’s AML/CFT framework.

• Experience working with regulatory institutions and international partners.

• Advanced degree in Law, Economics, or Financial Regulation.

Reporting

The consultant will report to the REMIT Team Lead and REMIT Macroeconomic Governance Component Lead.

LOE: 20 days

Application and Deadline

Interested applicants should email their resume (not exceeding two pages) with the position mentioned in the subject line to recruitment.remit@adamsmithinternational.com. The deadline to apply is 20 November 2025.

or

All done!

Your application has been successfully submitted!