ToR: Export Market Intelligence for Malawi’s Macadamia and Mango in EU, East Asia and Southeast Asia

- Hybrid

- Lilongwe, Central Region, Malawi

- Project Positions

Job description

Introduction

Background

Malawi Value Chains (MVC), implemented by Adam Smith International, is one of the components of the FCDO-funded Malawi Trade and Investment Programme (MTIP), a five-year initiative aimed at accelerating exports to break Malawi’s cycle of low growth. MVC focuses on enhancing productivity, quality and export competitiveness of the mango and macadamia value chains, with an emphasis on unlocking near-term commercial opportunities and strengthening the enabling environment.

Malawi’s macadamia and mango sectors present strong potential to drive foreign exchange earnings, employment creation and economic diversification. Both crops benefit from seasonal advantages, with Malawi’s mango entering global markets earlier than key competitors and its macadamia harvest aligning with demand in Europe and other high-value regions. However, Malawi’s exports remain constrained by regulatory hurdles, weak market positioning, limited knowledge of export markets and variety preferences, and insufficient engagement with buyers.

In response, MVC is commissioning an Export Market Intelligence Series to: (1) identify compliance requirements and buyer expectations in selected markets; (2) map and profile verified buyers and distributors; and (3) document consumer and variety preferences for dried mango and macadamia. The initiative builds on earlier competitiveness benchmarking studies, including carbon footprint studies and UK/EU-focused insights, and will serve as a learning mechanism to generate practical evidence that can shape decision-making on trade and investment in Malawi.

Rationale

Existing studies, including the MVC Competitiveness Benchmarking, ASI UK export guidance and CBI market reports, provide strong intelligence on the UK and some EU markets. However, critical information gaps remain, particularly on priority export markets in Europe, the Middle East and East Asia, as well as on buyer and consumer preferences in dried mango and macadamia segments in Europe – where Malawi has potential for increased market presence. These gaps prevent exporters and policymakers from exploring key market opportunities, making informed decisions and fully capitalising on trade preferences and seasonal advantages offered by these countries.

The missing intelligence is most notable in:

EU markets (Germany, Spain, France, Netherlands) where Malawi-specific insights on buyer requirements, certification standards, and pricing structures are limited and where there is limited understanding of how to leverage Malawi’s LDC status to secure and maintain preferential tariff advantages.

East Asian markets (Japan, South Korea, Taiwan) which demand high standards of quality and certification, and Malawi requires tailored intelligence to meet these expectations or fully benefit from LDC trade preferences.

South and Southeast Asian markets (India, Vietnam, Indonesia) where demand for healthy snacks is expanding, but there is little information on buyer requirements, distribution pathways and opportunities to leverage LDC tariff advantages.

In addition, exporters face challenges with logistics and certification that require clearer, practical market intelligence tools to navigate.

Objective

To generate actionable market intelligence that enables Malawi’s macadamia and mango exporters to grow exports by identifying new (for them) markets, addressing information gaps on buyers and their requirements, market compliance standards and providing insights on how Malawi can leverage its Least Developed Country (LDC) status to access preferential trade arrangements and strengthen export competitiveness.

Scope of Work

The consultant will generate market intelligence for Malawi’s macadamia and mango exports, covering market access and compliance requirements, verified buyer information, product and pricing trends, and firm-level readiness factors. The purpose is to equip exporters with actionable tools and evidence to engage buyers, strengthen compliance and inform targeted export promotion efforts that take advantage of Malawi’s LDC trade preferences

Market Coverage

EU markets: Germany, Spain, France, Netherlands

East Asian markets: Japan, South Korea, Taiwan

South and Southeast Asian markets: India, Vietnam, Indonesia

Outputs

For each priority market, the consultant will produce:

Market Access & Compliance Brief. Covering SPS, food safety, labelling/packaging (for bulk packaging), and documentation requirements.

Summary of key SPS, food safety, labelling, packaging, and documentation requirements.

Certification standards relevant to each market (e.g., product quality in the EU, sustainability/traceability in East Asia).

Applicable tariff preferences and non-tariff barriers, including procedures at border inspection points.

Analysis of applicable tariff preferences and non-tariff barriers, including opportunities to leverage Malawi’s LDC status for preferential access.

Designed as a practical reference document for exporters and MVC partners.

Buyer Directory. Including profiles of buyers, distributors, and agents

Verified list of importers, distributors, processors, and agents.

Contact details and buyer profiles, including product focus, volumes sourced, certification demands and procurement requirements and timelines.

Segmentation by channel (retail, foodservice, manufacturing/ingredient supply).

Structured format (spreadsheet or database) to enable MVC and partners to use directly in firm engagement and export promotion.

Exporter Guidance. Practical summary of compliance, packaging and documentation checklists.

Step-by-step checklist of compliance, certification, and packaging standards required for entry.

Illustrative “path to market” for a new exporter, highlighting critical documentation, inspections, and labelling/packaging adjustments.

Clear guidance on pitfalls/common exporter mistakes to avoid in each market.

Formatted as a concise how-to tool that can be shared directly with firms.

Market & Product Trends Brief. Insights on consumer preferences, product/variety positioning, and retail trends.

Insights on importer and bulk buyer preferences for product types, specifications, and packaging formats (e.g., macadamia kernel size, moisture content, dried mango slice style, sugar levels, or bulk pack sizes).

Analysis of product positioning requirements as determined by importers and processors who purchase in bulk for repackaging or further processing.

Summary of procurement cycles and purchasing criteria used by bulk buyers, traders, and ingredient suppliers.

Structured dataset (with optional photos/examples where feasible) to ensure comparability across markets.

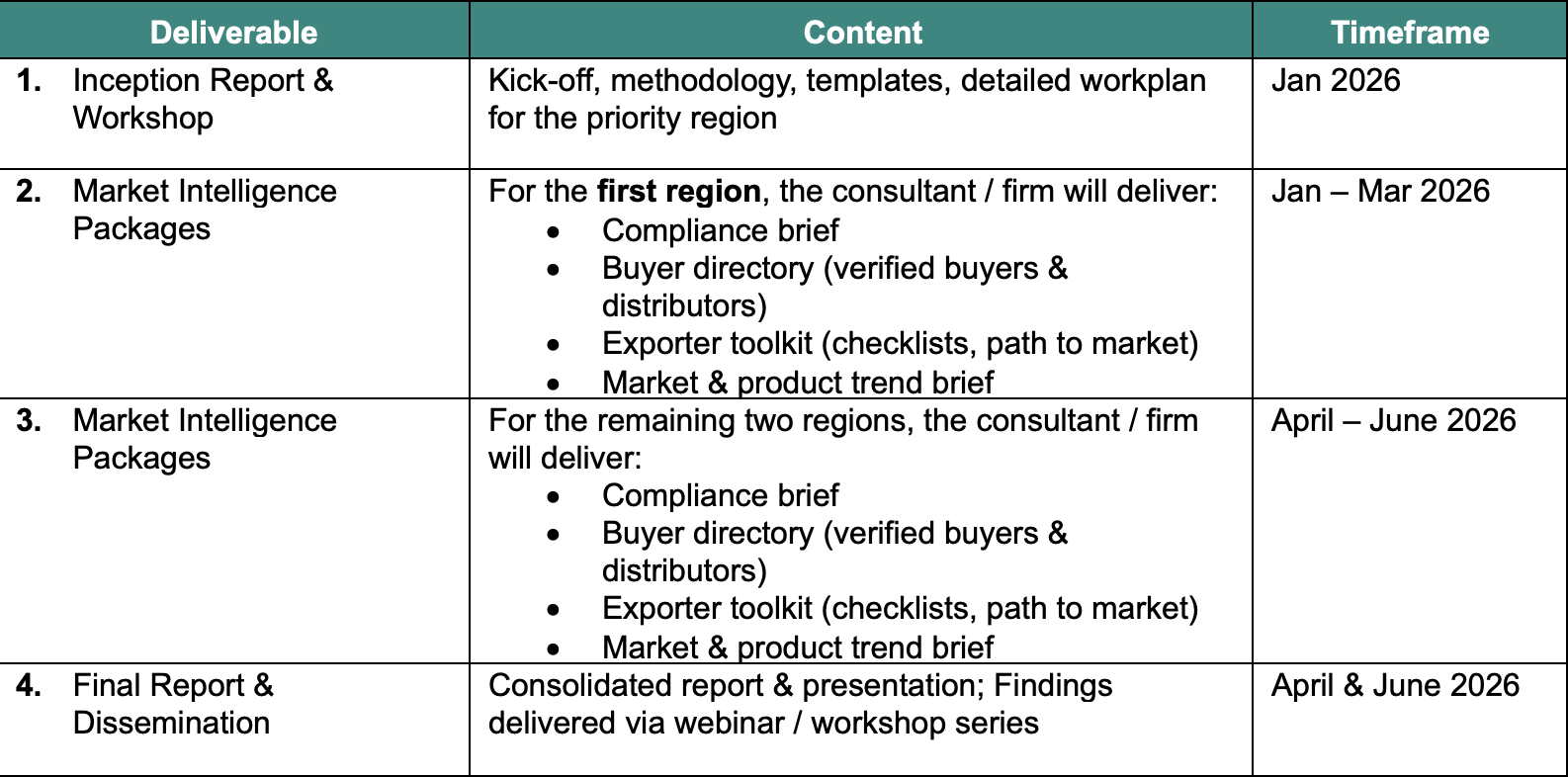

Delivery Schedule & Effort

Overall timeframe: January – June 2026, with anticipated deliverables as set out above.

Draft reviews & finalisation: Should be built into the planning and effort for each product

Level of Effort: estimated 25 consultant days per region.

Job requirements

Key Requirements

The selected consultant(s) or firm(s) should demonstrate the following skills, experience, and qualifications. Applicants are not expected to cover all regions and should clearly indicate in their proposal which region(s) they are applying for (EU and/or East Asia and/or South & Southeast Asia) based on their expertise, networks and past experience.

MVC will sequence the studies, rather than commissioning all three regions simultaneously. In line with the agreed approach:

One region will be commissioned first, to be conducted between January and March 2026

The remaining two regions will be commissioned from April 2026 onwards

Technical Expertise

Proven experience in international trade and export market research, particularly in agri-food value chains (nuts, dried fruits, or similar high-value crops).

Strong understanding of SPS, food safety, certification and regulatory compliance requirements in EU, Middle East and East Asia.

Demonstrated expertise in market intelligence, buyer mapping and consumer trend analysis, especially for premium food products.

Methodological Capacity

Ability to apply mixed-methods approaches, combining desk research, trade data analysis, buyer interviews and consumer surveys.

Experience conducting export readiness diagnostics and developing firm-level gap-closure strategies.

Proven ability to translate technical findings into practical, user-focused tools such as buyer directories, compliance checklists, market-entry guides and learning briefs.

Country visits are not anticipated, rather the reliance is on secondary sources and remote buyer interviews, as applicable.

Learning & Communication Skills

Strong track record of packaging insights into accessible learning products for exporters.

Experience & Track Record

At least 10 years of relevant professional experience in trade facilitation, export market entry/analysis, or related fields.

Demonstrated ability to engage with both public and private sector stakeholders, including exporters, buyers' agents and distributors.

Understanding of international trade policies, concepts including tariffs, non-tariffs, trade preferences and trade facilitation.

Qualifications

Lead consultant with demonstrated expertise in export market development and international trade intelligence. Academic qualifications may be substituted with equivalent practical experience, including proven success in buyer relationship management, market entry strategies and export business development.

Team members (if a firm) should include specialists in SPS/standards, market research, buyer engagement and communications/learning.

Other Competencies

Strong analytical and report writing skills in English.

Ability to work to tight deadlines and deliver high-quality outputs under pressure.

Language skills in Arabic, Japanese or Korean will be considered an added advantage for buyer interviews.

How to Apply

Interested consultants or firms are invited to submit a short proposal (no more than 6-8 pages, excluding annexes) at the link below that includes:

Understanding of the Assignment. Brief description of the consultant’s understanding of the objectives, scope, and expected outputs. Outline of the proposed approach and methodology, highlighting how the work will be delivered, building from the consultant’s experience.

Work Plan & Deliverables. Proposed work plan and timeline, aligned with the TOR. Any suggested refinements to the delivery schedule.

Relevant Experience. Summary of experience in international trade and export market intelligence, particularly in agri-food value chains and mango and macadamia. Examples of similar assignments undertaken.

Team Qualifications. Provide concise CV profiles (maximum 6 pages in total) of proposed personnel, clearly outlining relevant expertise and years of experience. Indicate the role and responsibilities of each team member (if more than one).

Budget & LOE. Estimated number of days and daily rates for each team member. Total proposed budget (fees and expenses).

The deadline to submit is 16th January 2026.

or

All done!

Your application has been successfully submitted!