ToR: Short-term consultancy to develop a business case for review of the current tax structure in the macadamia industry

- On-site

- Lilongwe, Central Region, Malawi

- Project Positions

Job description

1. Background

Malawi Value Chains (MVC), implemented by Adam Smith International (ASI), is one of two components of the Malawi Trade and Investment Programme (MTIP), a five-year FCDO-funded initiative which aims to break Malawi’s cycle of low growth through driving exports. The overall objective for MVC is to implement the value chain component of MTIP with the goal to increase the productivity, quality, production and export performance of the macadamia and mango value chains, as well as support increased mining investment and ultimately exports.

Malawi's agricultural sector presents significant growth potential that can transform the country’s role in global agricultural trade. This is emphasised in the Second National Export Strategy (NES II), which defines the medium- and longer-term strategy for sustainable economic growth through high-value agro-based exports. Macadamia and mango are two value chains with demonstrable potential for increasing exports, value addition and economic diversification.

The Malawi Macadamia Association (MMA) represents a key agricultural value-chain that has grown to become the third largest producer in Africa and the seventh largest globally. The industry is a significant source of foreign exchange and employment. However, the macadamia has a long gestation period, with orchards only reaching breakeven approximately 10 years after establishment.

This long investment horizon is misaligned with several provisions in the Malawi’s tax structure, which are more suited to shorter-cycle industries. In November 2023, MMA submitted proposals for tax concessions to the Malawi Revenue Authority (MRA). While the MRA Technical Committee was satisfied, the proposals were not fully considered by the Ministry of Finance. There is a recognised window for further lobbying during the 2026/27 budgetary consultations. A critical first step is the development of a strong, evidence-based business case to justify proposed reforms that should support investment in the macadamia value chain; its growth and increased exports that result from such growth.

The MMA, with support from MVC, seeks to engage a qualified consultant (firm or individual) to develop a Business Case for the review of the Malawi Tax laws that affect the macadamia industry that will help the MMA to lobby the Government during the budget consultations.

2. Rationale and Objectives

The primary objective for this assignment is to create a compelling, data-driven argument for revising specific tax policies and law to better align with the macadamia industry's investment cycle, thereby enhancing its investment attractiveness and long-term sustainability.

The key objectives are to:

Analyse the current tax structure's impact on the profitability and investment appeal of the macadamia value chain.

Develop a comprehensive business case justifying specific tax reforms, with a primary focus on extending the expiry of assessed losses from six years to a duration that makes business sense for irrigated and unirrigated macadamia orchards, of at least 10 years.

Provide well-reasoned justifications for additional proposals of tax revisions whose business case can be prepared in parallel with the case for extension of expiry of assessed losses. (To see additional proposals, kindly refer to the attached MMA Tax Lobbying Strategy.)

Produce a final report and strategic positions suitable for submission to the Ministry of Finance to inform the upcoming budget consultation and aid MMA to use as reference notes during the negotiations, respectively.

3. Methodology

The consultant should use a mixed-methodological approach, including but not limited to:

Document Review: Analysis of the MMA's previous submissions, current tax laws, and relevant national policies.

Stakeholder Consultations: Conduct interviews with Financial Managers from a representative sample of MMA members (macadamia growers from both irrigated and non-irrigated) who will be able to supply data for the analysis.

Financial Modelling: Analyse financial data from selected growers to quantify the impact of current tax measures (e.g., loss from expiry, thin capitalization) on cash flow and investment recovery and to model projected benefits of revisions to growers and the Government in the medium to long term.

Comparative Analysis: Briefly review tax incentive frameworks for tree crops like macadamia in comparable origins like South Africa, Mozambique, Zambia or Kenya.

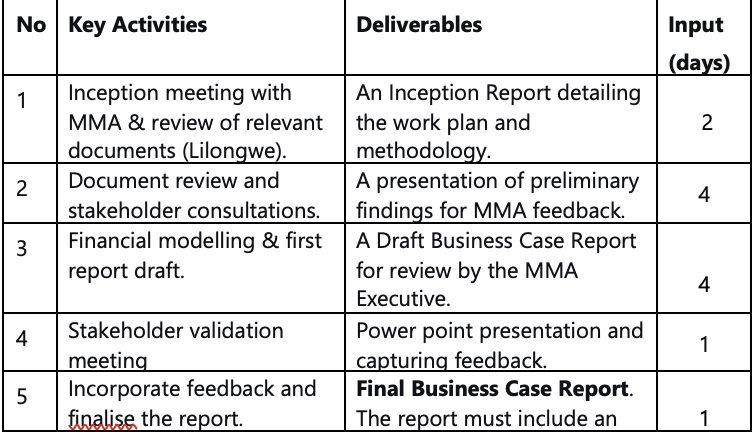

4. Activities and Deliverables

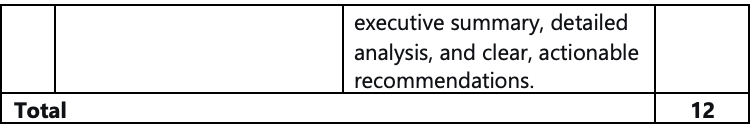

5. Timing and Duration

The total duration for this assignment shall not exceed 12 working days. The assignment must be completed, and the final report delivered by 16th January 2026. The proposed schedule is as follows:

Job requirements

Key Requirements

The ideal consultant/firm should demonstrate:

Must be a chartered accountant or possess an advanced degree in Economics, Finance, Tax, or a related field.

Proven experience (minimum 10 years) in tax policy analysis, advisory, and developing business cases for public or private sector clients.

In-depth knowledge of the Malawi Taxation Act and related laws.

Familiarity with the agricultural sector with focus on tree crops is essential.

Excellent analytical, report-writing, and presentation skills.

Ability to work independently and deliver high-quality work within a tight deadline.

How to Apply

Interested and qualified consultants should submit the following:

A technical proposal (maximum 3 pages) detailing their understanding of the assignment, proposed methodology, and work plan.

A financial proposal breaking down days, fee rates and other expenses.

Curriculum Vitae (CV) of the consultant(s)

Copies of relevant certificates and registration documents

Evidence of similar work undertaken (e.g., sample reports or client references)

The deadline for submissions 20th December 2025. Technical and financial proposals should be submitted by to: administrator@malawimacadamia.org and copy to info@malawivaluechains.com

or

All done!

Your application has been successfully submitted!